What is Doji candle pattern and how many types are there?

Dear traders, in this lesson we will learn what is Doji candle pattern and how many types are there, and how this Doji candle pattern is seen on the chart, and where to use it and how effective it is.

What does Doji candle pattern mean?

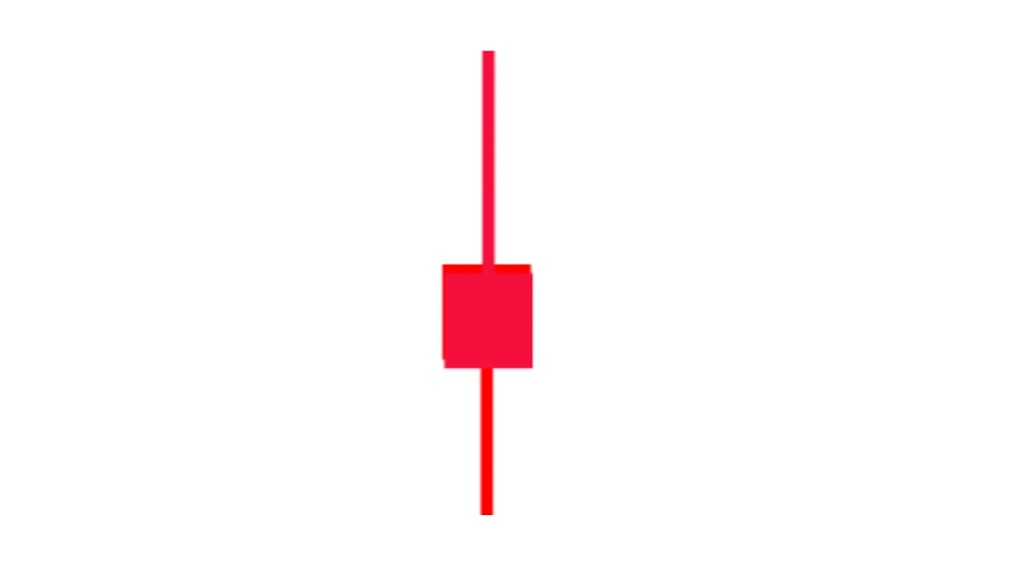

An incomplete candle is formed i.e. body is formed in the middle and above it is in the middle of the candle (shadow).

If you see such a candle anywhere in the market, then it is a doji candle. If you see such an opening on any timeframe in the market and that candle looks a little high and a little low, after that the market neither goes up nor down, it makes a closing in between, then it is called a doji candle. The color of a doji candle is red as well as green.

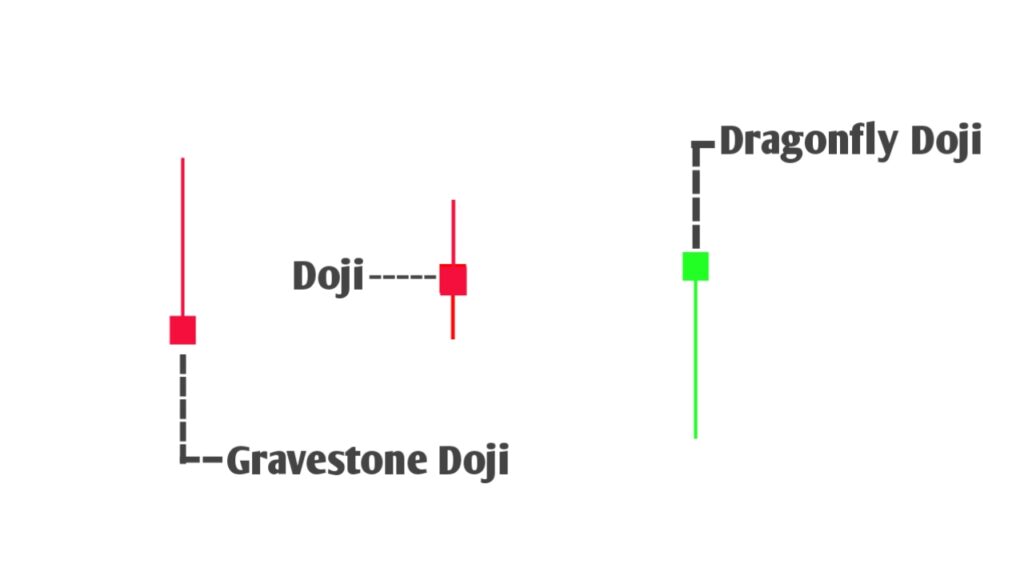

How many types of doji candle patterns are there? There are two types of Doji candle patterns, the first candle is Gravestone Doji and the second is Dragonfly Doji.

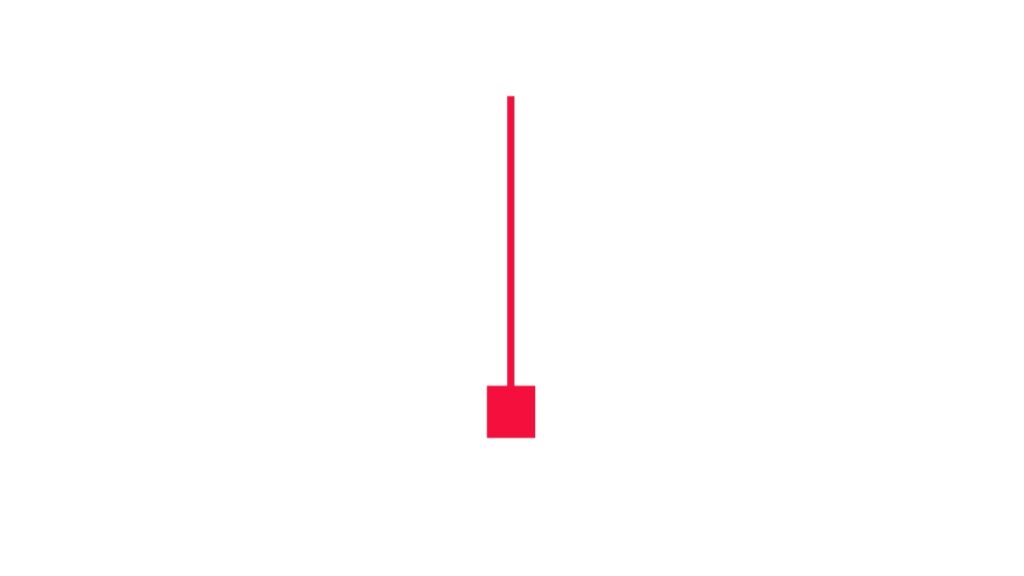

Gravestone Doji Candle:- A little body will be formed in this candle and a shadow will remain on the top, this candle shows that this kind of candle is a seller candle, you can see both red candle and green candle in this candle.

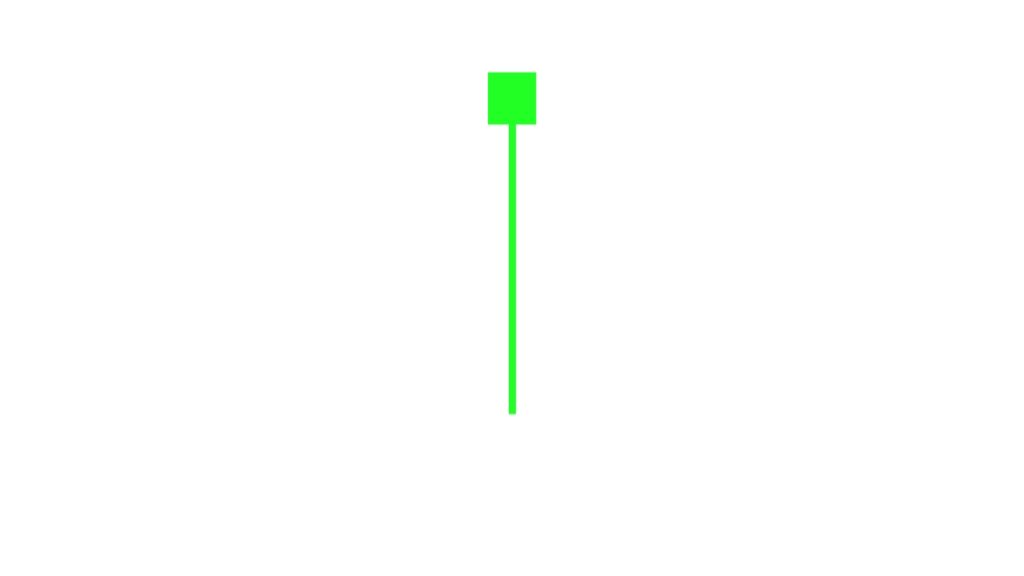

Dragon Doji Candle:- A little body will be formed in this candle and a shadow will remain on the bottom, this candle shows that this kind of candle is a bar candle, in this also you will see red or green candle.

How to trade on Gravestone Doji Candle? If you see the market uptrend and a Gravestone Doji candle is formed anywhere on the chart, then think what can be the psychology here, the buyers who are coming from below and buying, they think what will happen to them, I am making a good profit, I hope it doesn’t become a loss, due to this, as soon as the candle breaks, the buyers start booking their profit, so here you can see four-five candles profit, that is, it should be of 20 to 25 minutes time period.

Can uptrade be taken on Dragonfly Doji Candle? If you see the market higher high and a Dragonfly Doji candle is formed somewhere, then it is a trend continuation candle in the market. If you do not understand the psychology behind it, whether the seller came in the market but could not close it down, then it can be clearly seen here that the seller is not looking strong, then the psychology ahead can also be this, a bar can come here, then you can trade by putting a Low Stoploss here and you do not have to keep the target high, just keep it at 1:2, if the market is in up-trade then you can also take a target of 1:3.

How can you take a DownTrade on Dragonfly Doji Candle? If you are repeatedly seeing the market going low and a Dragonfly Doji candle is formed somewhere, then think about the psychology behind it, if the bar came in the market but was not able to close higher, then what will happen to the trend, I was making good profits, I should not incur any loss, due to this I can make profit for three-four candles, if the market reverses from here and takes a break of 50-60%, then you can trade from here from the starting candle, which can give you good profit

note

It has been made for information purpose only. Please do some recharge and then only invest.